Have you ever heard of the 50 30 20 rule for budgeting before? If not, this post is going to teach you all about what it means and how to successfully figure out a budgeting plan that works best for you.

We love this budget strategy because it works great for beginners and can help you save money to pay off any debt!

If you’re unfamiliar with the 50 30 20 rule, don’t fret. We’re going to make it super simple and easy to understand!

If you’re ready to start getting serious about budgeting and saving money, the 50 30 20 rule is one that might be just perfect for what you need.

Also, if you’re new to budgeting – I love Dave Ramsey’s Total Money Makeover and the Automatic Millionaire!

Both are straight forward and super easy to implement!

What is the 50 30 20 budgeting strategy?

The 50-30-20 Budget Strategy has been growing in popularity over the years. Now thousands of people budget their income and expenses using this one rule.

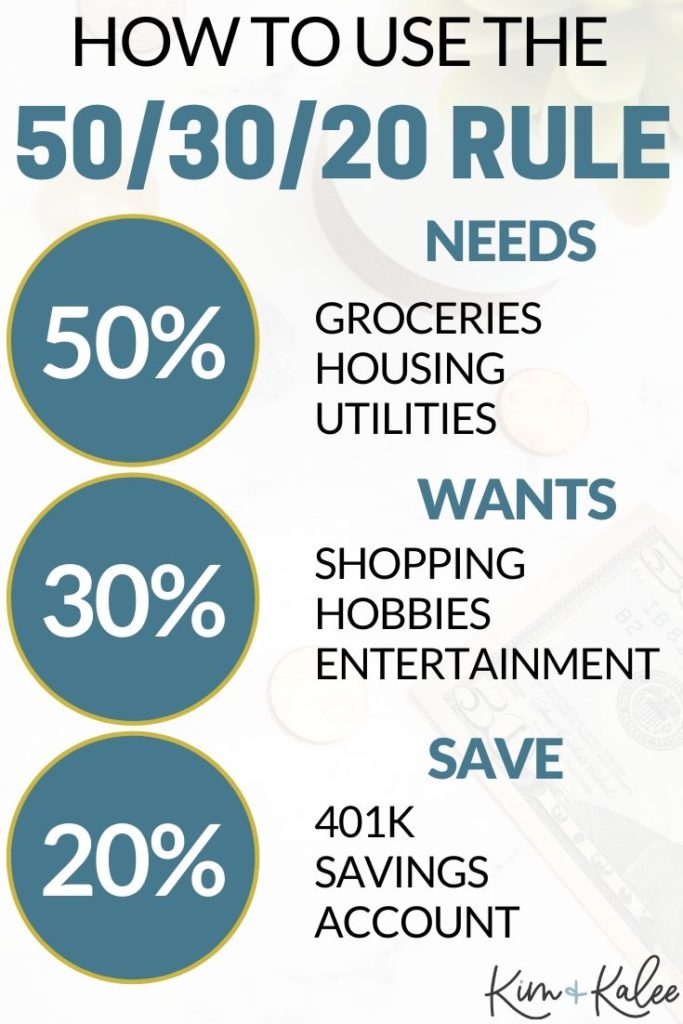

The basic premise behind this strategy is that:

- 50% of your income should be used for needs,

- 30% of your income used for wants,

- and 20% of your income placed into your savings for safe-keeping.

Is the 50 30 20 rule before or after taxes?

This is all based on after-tax income.

Does the 50 30 20 rule include 401K contributions?

It actually does!

The part of the equation that states that 20% of your income should be placed into your savings can be used for your 401K needs as well.

How do I know if the 50 30 20 rule is right for me?

That’s the thing. There isn’t always a one-size-fits-all budgeting plan that is going to be perfect for everyone to follow.

If you know that your goal is to save money, you’ve got to start somewhere to make it happen.

What people love about this budgeting strategy is that it’s simple and easy to follow.

Right from the start, you know exactly what you should be doing with what portion of your money so there leaves little room for manipulation or movement.

And honestly, this is what some people need.

Creating a budget and following it can be really hard and stressful, but this is where these types of budgeting techniques can really come in quite handy.

When the 50 30 20 Rules Doesn’t Work

Depending on your income, you may not have the ability to actually spend 30% on your wants or save 20%. You could always customize these percentages and create a budget to fit your needs.

Another option would be to try a money saving challenge!

Breaking Down The 50 30 20 Rule for Budgeting

If you’re on the fence about whether or not this is a good route for you to take to try to fix your finances, let’s break it down even more so you can have an even more clear picture in your mind on how you can make it work for you.

50% Of Your After Tax Income Goes to Needs

If you know that 50% of your income should be used on needs, this means that that portion of your money is to be used for your mortgage, insurance, and other monthly bills that are a requirement for you to pay.

30% Of Your After Tax Income Goes to Wants

For the 30% of your income that is for wants, keep in mind that it doesn’t necessarily mean that you have to spend all 30% on fun things like eating out and entertainment.

It just means that you can technically budget that amount each and every month and still stay on track with your spending.

If you want to put some extra in savings one month instead of eating out or doing something fun, go for it!

It’s fine to go below the percentage goal allowed. The problem only starts when people exceed the allotted monthly amount!

20% Of Your After Tax Income Goes to Savings

The remaining 20% that is to go into your savings is important because that is money for your future.

Plus, when you get into a habit of saving money automatically every single month, you really don’t even notice that money missing from the present at all.

Is it better to save or pay off debt?

This can be a tricky one to answer, and it really boils down to what your personal preference is.

If you’re wanting to be debt-free and live that life, then it’s going to be better for you to follow that dream and financial goal, and pay off your debt.

But if you’re one that likes to have a little bit more of a safety net and don’t feel comfortable spending all their money to get out of debt right then and there, you might find comfort in being a little bit in debt and saving money each month, too.

My $1000 Emergency Fund

When I had $30,000 in student loans, I decided I wanted to have a $1000 emergency fund, and then I put the rest of my income towards my debt.

The $1000 was a project for me.

I sold clothes on Poshmark, clipped coupons, used money saving apps, saved every penny I could and hit $1000 pretty quickly.

Here are a few Secrets on How to Make Money Online to help you get started as well!

Then, I started putting more than the minimum payment on my student loans. (If you just do minimum payments, the interest can eat you alive!).

Why not make this year the year to give the 50 30 20 rule a try?

It’s a simple way to save money and budget and you just might find that it’s the perfect way to get you out of debt as well!

You may also like these money-based books!